BFSF/FMV Trends & Best Practices

Author’s note: In this article, we summarize our latest conference discussion on hot topics, trends, and leading practices in Bona Fide Service Fees (BFSFs) and fair market value (FMV). Should you have any questions or thoughts to share, please feel free to contact us; we would be glad to help you.

Get the copy of the presentation for offline reading or reference: Download PDF

Table of Contents

- Bona fide service fees (“BFSFs”) & fair market value (“FMV”) overview

- Trends and tips for conducting and maintaining a successful BFSF & FMV analysis and process

- Best practices

BFSF/FMV Overview

Bona Fide Service Fee Definition and Test

Fees paid by a manufacturer to an entity, that represent fair market value for a bona fide, itemized service actually performed on behalf of the manufacturer that the manufacturer would otherwise perform (or contract for) in the absence of the service arrangement, and that are not passed on in whole or in part to a Company or customer of an entity, whether or not the entity takes title to the drug.

42 C.F.R.§ 447.502 – Medicaid regulatory definition of BFSF

The fee includes but is not limited to, distribution service fees, inventory management fees, product stocking allowances, and fees associated with administrative service agreements and patient care programs (such as medication compliance programs and patient education programs).

42 C.F.R.§ 414.802 – Medicare Part B Average Sales Price regulatory definition of BFSF

Discuss with your counsel and government pricing / BFSF / FMV advisors to ensure appropriate treatment of service fees in Non-FAMP calculations.

Non-FAMP VA sub-regulatory guidance

October 2006 Dear Manufacturer Letter:

“…wholesaler fees associated with inventory management agreements, fees charged by general wholesalers to manufacturers that have chargeback arrangements with them, are excludable from non-FAMP, as long as they are defined services charges imposed on manufacturers generally.”

October 2007 Dear Manufacturer Letter:

“…percent of sales incentive fees offered to wholesalers, in order to achieve business goals of the manufacturer, [are] not…IMA fees that are excludable from non-FAMP.”

Do Bona Fide Service Fees Matter and Why?

BFSF analysis is relevant to:

- Government price reporting (AMP, BP, ASP, FSS)

- Reimbursement rates and remuneration within supply chain arrangements

- IRA rebates and price caps/ceilings based on Non-FAMP

- Gross to net reporting

- Compliance and legal exposure

Legal risk:

- Potential civil monetary penalties

- Knowingly submitting false pricing or product data

- Misrepresentation in the reporting of ASP data

- Knowing and intentional 340B overcharges

- Potential False Claims Act and other liability

- E.g., potential Anti-Kickback Statute liability

Enforcement:

- Settlements

- Litigation

- E.g., AstraZeneca and Cephalon paid $46.5M, and $7.5M, respectively, for allegedly underpaying MDRP rebates (allegation that they mischaracterized payments to wholesalers as non-bona fide service fees) (see also recent Eli Lilly case)

- Cardinal

Entities that may require BFSF Analysis

Below is an Illustrative list of service arrangement types that may require analysis. Manufacturers must determine the ultimate list of entities that require this analysis:

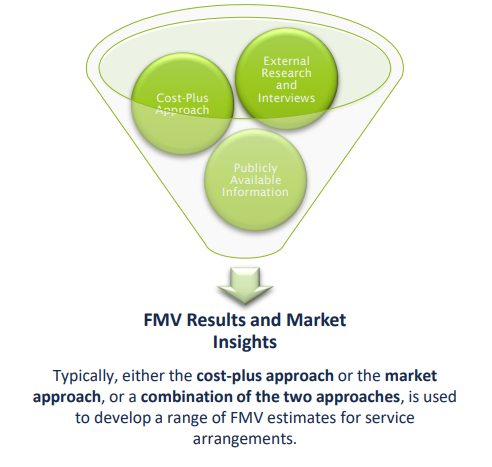

Fair Market Value Approach and Methodology

Typically, either the cost-plus approach or the market approach, or a combination of the two approaches, is used to develop a range of FMV estimates for service arrangements.

Cost-Plus Approach

- The cost-plus approach considers the total direct and indirect costs as well as a level of overhead and profit that would be incurred by a market participant to recreate the activities. The cost-plus approach is based on the premise that the FMV of the service is driven by the opportunity cost of providing the service. Includes building the value of components in a service activity.

Market Approach

- The market or sales comparison approach is a general way of estimating the value of a business or tangible or intangible asset using one or more methods that compare the subject to similar investments or assets that have been sold or offered for sale. Sales or offering prices for the comparable investments or assets are adjusted to reflect the differences between the investment or asset being valued and the comparable investments or assets.

- We will consider both the cost-plus and market approaches, where data is available, in developing FMV ranges for the service fees to support the analysis. We will review assumptions and results for each approach and select the relative weighting of the two approaches to arrive at an FMV range.

- Used when comparable market data is available or when cost approach is not definitive. Key inputs include agreement type, execution date, service type, service performed, product type and manufacturer size and type.

CMS Relevant FMV Guidance

- CMS refrains from defining “Fair Market Value.” Instead, the agency says “we believe the determination of fair market value is by nature subjective [A]ny documentation can be used, provided that it makes clear the methodologies or factors … [S]uch determination of fair market value and documentation be made contemporaneously with the manufacturer’s agreement to pay the fee.” 81 Fed. Reg. 5170, 5180 (Feb. 1, 2016).

- In the Preamble to the Medicare Part B Final Rule, CMS states that “bona fide service fees means expenses that generally would have been paid for by the manufacturer at the same rate had these services been performed by other or similarly situated entities.” 71 Fed. Reg. 69624, 69669 (Dec. 1, 2006)

BFSF Hot Topics and Trends

Regulatory (External)

- Inflation Reduction Act and the importance of BFSF to various statutory provisions

- OIG Survey of Manufacturer ASP Data

- Reasonable assumptions. OIG 2019 survey found that almost all manufacturers (91%) adopt reasonable assumptions around BFSFs in connection with BP or AMP reporting:

- More than half of manufacturers requested additional agency guidance around BFSFs

- FMV determination

- Pass through (e.g., what is considered evidence or notice of pass-through)

- Specific questions around admin fees to PBMs

Process (internal)

- Determining which entities require analysis (i.e., do affiliates of trade partners require analysis, what about entities that only aggregate data, etc.)

- Understanding criteria to determine if a service is Bona Fide

- E.g., what services are bona fide services? What services are really on behalf of the manufacturer? Are the services sufficiently itemized? What are reasonable steps to take regarding pass-through?

- How to navigate VASF determination

- What guidance should be relied upon? Do you rely on CMS guidance, VA guidance, a mix, or make assumptions?

- What kind of BFSF/VASF documentation and process should manufacturers have in place?

Examples of Vertical Integration

The table below highlights vertical integration in the PBM and specialty pharmacy sector*. Note this is just an example list and there are many others including distributors being affiliated with data aggregators, patient assistance programs, etc. It’s important to know your vendors.

Hypothetical BFSF/FMV Process Overview – Initial BFSF / FMV analysis

- Identify services and fees.

- Collect and review relevant contracts to summarize services and fees to be evaluated and analyzed.

- Evaluate services & fees using BFSF test*

- Conduct workshops with Company SMEs and Counsel, if needed to review identified services and fees against the qualitative portions of the BFSF test.

- FMV analysis*

- Perform FMV analysis on services and fees that pass qualitative portions of BFSF test utilizing data and information provided by Company SMEs.

- Preliminary results & draft deliverables

- Compile and review preliminary FMV results; Provide draft copies of FMV report and BFSF grid to Company and Counsel, if applicable for review.

- Finalized FMV Report & BFSF Grid

* Note the FMV may be performed at the same time as the BFSF qualitative tests are being evaluated. Additionally, the qualitative elements of the BFSF may change from time to time (e.g., a company might receive evidence of pass-through, and this may affect the BFSF analysis).

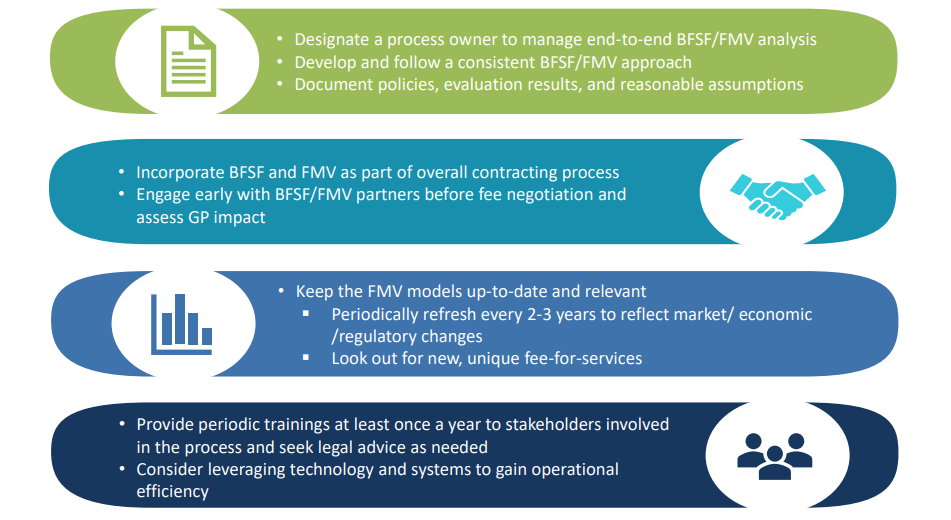

Best Practices