The Inflation Reduction Act and Impacts on Gross to Net

Author’s note: In this article, we summarize our latest conference discussion on the Inflation Reduction Act (IRA) of 2022 and its effects on the pharmaceutical industry, delving into key provisions impacting prescription drugs and Gross to Net (GTN). Should you have any questions or thoughts to share, please feel free to reach out to us, and we would be glad to help you.

Get the copy of the presentation for offline reading or reference: Download PDF

Table of Contents

- Overview

- The Inflation Reduction Act of 2022 (IRA) provisions impacting prescription drugs and GTN:

- How to Prepare

Overview

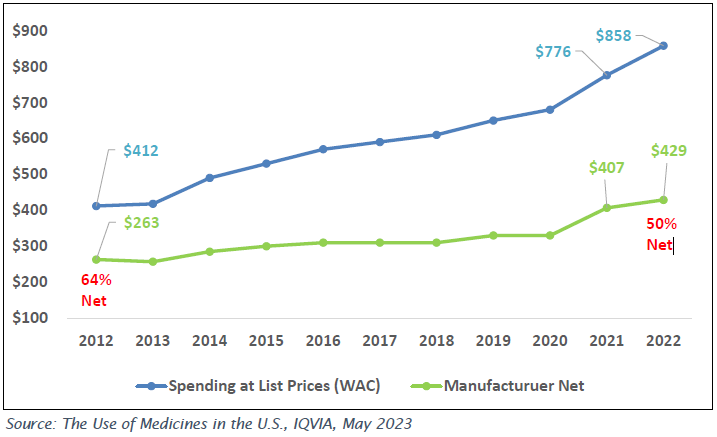

Gross to net Pressure has increased through the years

From 2017 – 2022, WAC sales has increased an average of 7.4% per year, while manufacturer net price growth has trailed at an average of 5.6% over the same five year period.

Medicine spending at selected reporting levels, US$Bn

- While manufacturer Net Sales dollars have increased over the period, Net Sales as a percent of U.S. spend has declined from 64% in 2012 to 50% in 2022.

- Several factors have contributed to the increase in GTN deductions over time, including:

- Increased discounts and utilization through government payers, driven largely by Medicaid expansion through the years.

- Growth in the 340B dug pricing program.

- Increased consolidation among Pharmacy Benefit Managers and Payers, increasing the bargaining power of these combined entities .

- Similarities among products within a therapeutic area, driving the need for manufacturers to pay higher rebates to maintain formulary position

With the implementation of the drug provisions in the Inflation Reduction Act, we will see this GTN trend continue as drug discounts will increase across Government and Commercial books of business in the coming years.

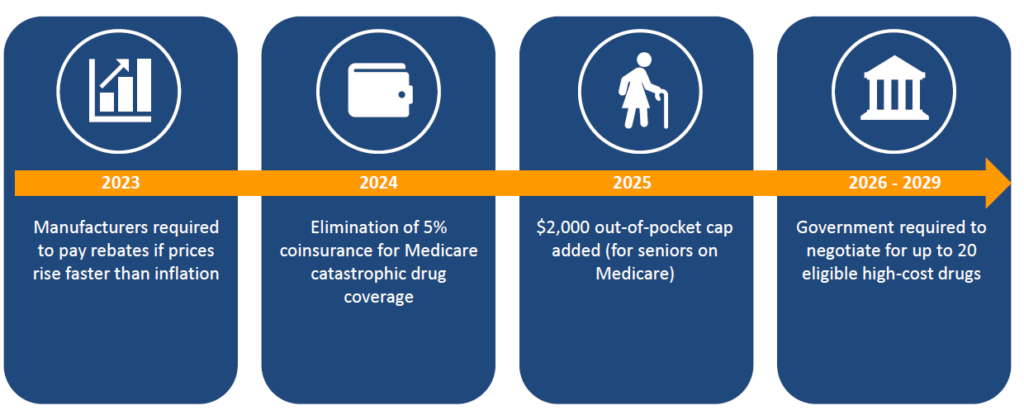

- Drug Price Negotiation Program

- Requires the federal government to negotiate prices for selected top selling drugs covered under Medicare Part D and Part B.

- Medicare Part B and Part D Inflation Rebates

- Requires drug companies to pay rebates if prices rise faster than inflation for drugs used by Medicare beneficiaries.

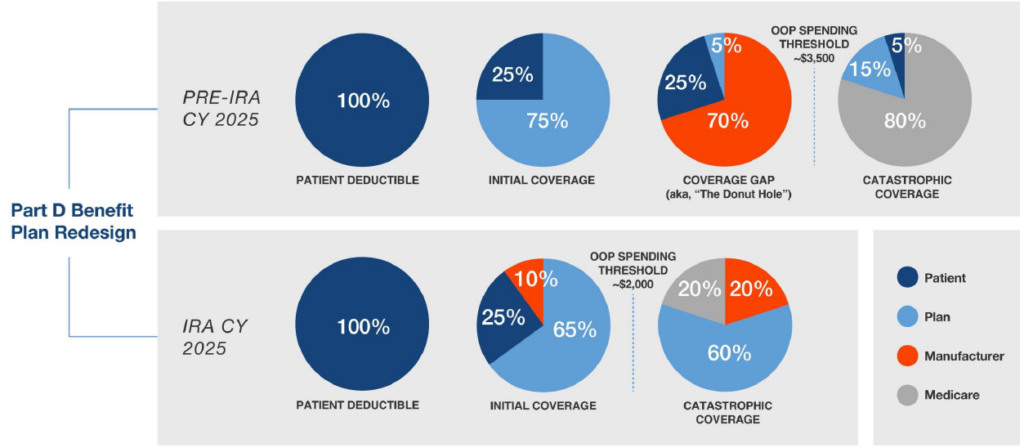

- Medicare Part D Benefit Redesign

- The Coverage Gap will be eliminated, and there will only be three benefit phases: the deductible phase, the initial coverage phase, and the catastrophic coverage phase.

- Apart from the IRA, AMP CAP removal is also taking effect in 2024, further compounding GTN Pressures

IRA / Medicare Drug Pricing Timeline

Drug Price Negotiation Program

Overview

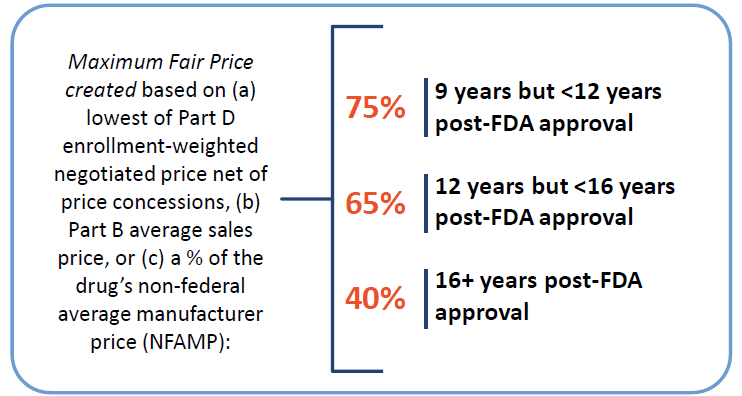

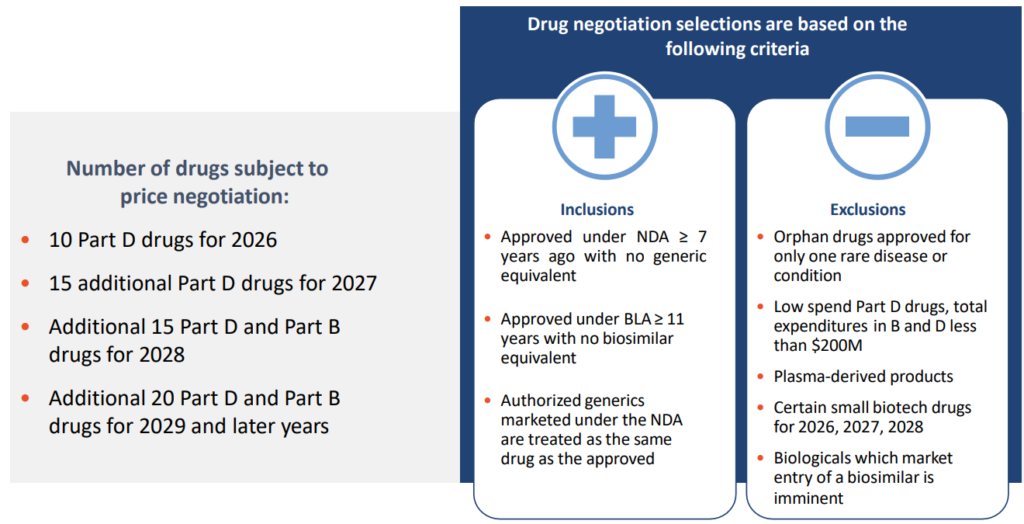

Federal Government will be required to negotiate prices for certain single source high spend drugs covered by Medicare.

- Beginning in 2026, drugs will be selected from the 50 highest total Medicare Part D spending and an additional 50 with the highest total Medicare Part B spending. Over time, the number of drugs with negotiated prices available will accumulate.

- Non-interference clause added

- Requires Secretary of HHS to negotiate prices with manufacturers for a small number of single source brand name drugs or biologics without generic or biosimilar competitors that are covered under Medicare Part D (starting in 2026) and Part B (starting in 2028)

Eligibility and Selection Criteria

Federal Government will be required to negotiate prices for certain single source high spend drugs covered by Medicare.

GTN Considerations: Medicaid and 340B

While the MFP only impacts a small number of high-spend drugs selected for negotiation, this will have significant impact for those drugs and could have spillover effects across the market.

- The Maximum Fair Price is included in the Medicaid Best Price (BP)

- Medicaid URA will increase as a new BP will likely be established with the MFP, thereby increasing manufacturer Medicaid exposure.

- As the 340B price is derivative of the Medicaid calculations, 340B price will go down, thereby increasing manufacturer 340B chargeback exposure.

- For products competing with the MFP negotiated product, should manufacturers consider additional Supplemental Rebate Agreement to maintain their position on State Formularies?

GTN Considerations: Payer Contracting

While the MFP only impacts a small number of high-spend drugs selected for negotiation, this will have significant impact for those drugs and could have spillover effects across the market.

- The MFP is published by CMS, so the price point is public and can be leveraged by Commercial Managed Care Plans when negotiating with manufacturers submitting new bids.

- If MFP is established as a new benchmark for negotiation with commercial payers, this will increase PBM rebates and can set Best Price even for manufacturers with drugs competing in a therapeutic class but not selected for MFP.

Magnolia Market Access (MMA) fielded a Payer Insights survey to gauge early reactions from payers as they digest Inflation Reduction Act (IRA).

- Nearly half of payer respondents believe their Plan’s Part D contracted Rates are already lower than what Government negotiation will yield.

- However, most respondents anticipate redesigning formularies to prefer drugs not subject to MFP negotiations, which could have a huge GTN impacts for competitive brands.

Do you foresee your organization making significant changes to its MAPD and standalone PDP formularies to prefer drugs not subject to maximum fair price (MFP) negotiations?

Source: Magnolia Market Access Inflation Reduction Act Payer Insight Report

Medicare Part B and Part D Inflation Rebates

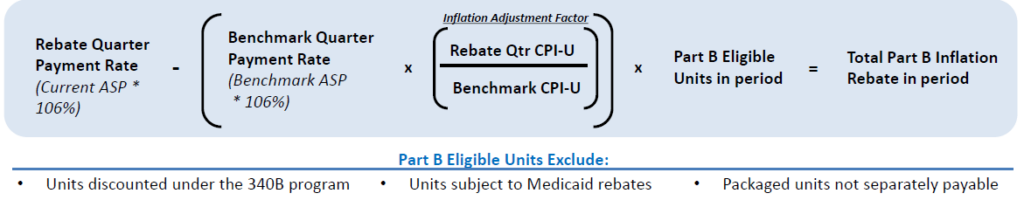

Part B Inflation Rebate

Calculation

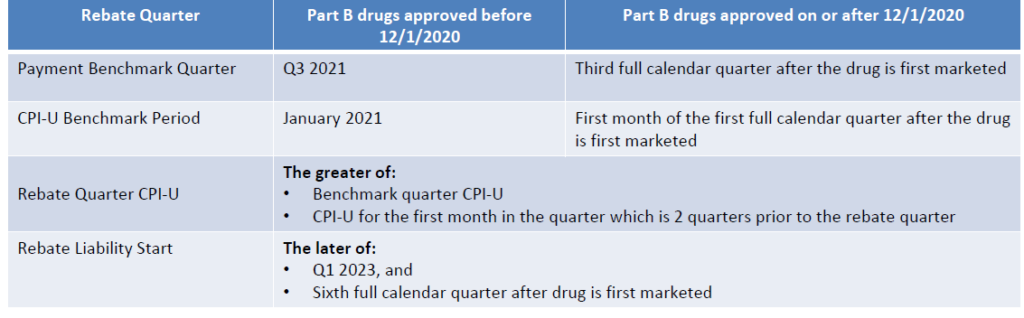

Benchmarks for Calculation

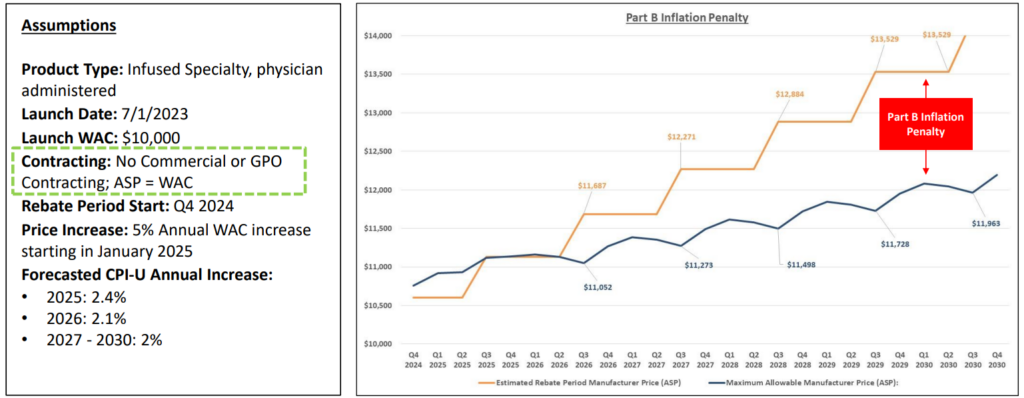

Example: Part B Inflation Rebate Forecast

Key takeaway:

While ASP management is essential for provider economics / cost recovery, a higher ASP can impact the Part B rebate owed by manufacturers; finding the right balance of contracting and price increase magnitude and frequency is a delicate balance.

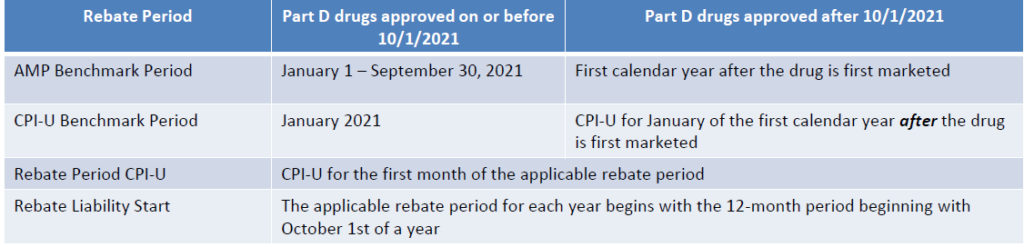

Part D Inflation Rebate

Calculations

Benchmarks for Calculations

Example: Part B Inflation Rebate Forecast

Key takeaway:

For established retail products, based on baseline AMP, CPIU, and pricing actions, Part D inflation rebates may not trip until future years. However, since the rebate period is the 12-month period beginning with October 1st of a year, price increases at the beginning of a calendar year can affect prior years and need to be forecasted accurately or risk impacting prior year budget and accruals.

GTN Considerations : Additional Margin Pressure

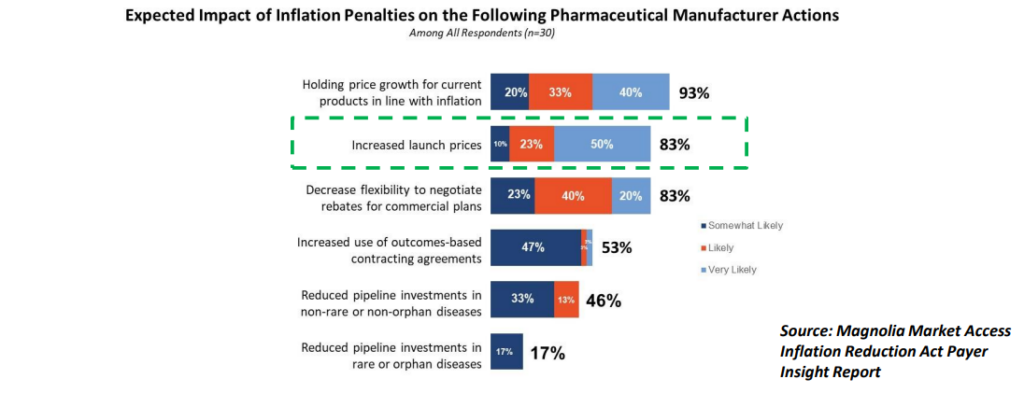

While the inflation rebates for Part B and Part D will have a direct impact on GTN, there are other considerations, such as planning for new product launch timing and launch price.

- Medicare inflation rebates will be in addition to the Price Protection that manufacturers are already paying for drugs contracted with Part D PBMs and payers, and CPI penalties with Medicaid.

- AMP cap removal goes into effect in 2024, compounding the rebate pressure experienced from CPI penalties and inflation rebates.

From the MMA Payer Insight Survey:

- 67% of Payer Respondents Currently Report Using Inflation Controls in Their Medicare Part D Contracts.

- However, Half of Respondents Anticipate Payers Will Expect Pharmaceutical Manufacturers to Pay Inflation Rebates Twice

Do you anticipate payers will expect pharmaceutical manufacturers to pay inflation rebates twice, i.e., both to a plan that has inflation penalties in their Part D contracts and to CMS?

Source: Magnolia Market Access Inflation Reduction Act Payer Insight Report

GTN Considerations: Launch Timing and Pricing

While the inflation rebates for Part B and Part D will have a direct impact on GTN, there are other considerations such as planning for new product launch timing and launch price.

Part B Launch Price and Timing

- For Part B drugs, the Benchmark Payment Rate for drugs approved after 12/1/2020 is the third full quarter after the drug is first marketed.

- If a company launches mid-quarter, consideration will need to be given to the timing of channel discounts (stocking discounts, e.g.,) prior to third full quarter, as these discounts would increase the impact of future price increases within the inflation rebate calculation.

Part D Launch Price and Timing

- For Part D drugs, Benchmark Payment Amount for drugs approved after 10/1/2021 is the first calendar year after the drug is first marketed.

- When planning for product launch, if a product is approved and marketed within a calendar year, this could actually delay the requirement to pay inflation rebates.

From the MMA Payer Insight Survey: while most respondents agreed that inflation penalties could keep price growth steady, 83% believe they will result in Increased Launch Prices.

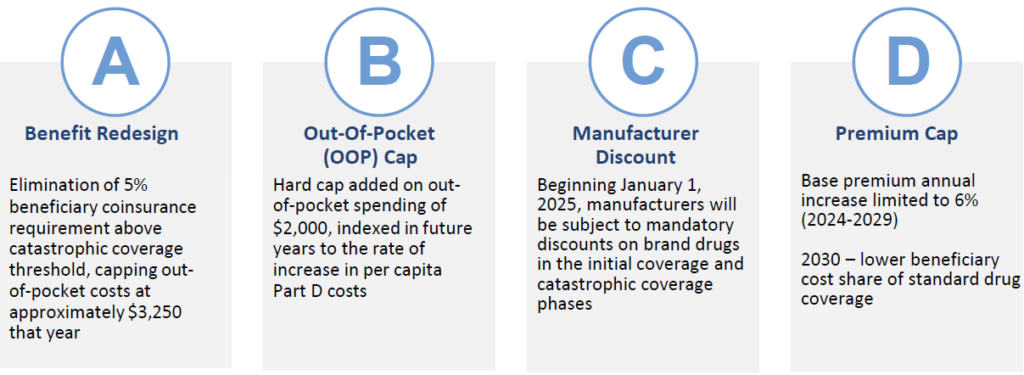

Medicare Part D Benefit Redesign

The Four Components of the Medicare Part D Redesign

Overview: Intention is to shift greater portion of drug coststo Part D plans and manufacturers. Coverage gap phase (“donut hole”) will be eliminated. Beginning January 1, 2025, manufacturers will be subject to mandatory discounts on brand drugs in the initial coverage and catastrophic coverage phases.

Coverage Gap Elimination

Eliminates Medicare Part D Coverage Discount Program and Shifts Cost Sharing to Manufacturers and Part D Plans.

Manufacturer Discount

Overview: Starting in 2025, Medicare Part D plans and Manufacturer’s liability is reduced for spending above the out of pocket cap. Discount to be phased in gradually for certain manufacturers with a small share of Part D spending. New manufacturer discount does not count as enrollee OOP spending.

- Medicare’s share of total costs above the spending cap (“reinsurance”) will decrease from 80% to 20% for brand-name drugs and to 40% for generic drugs.

- Part D plans’ share of costs will increase from 15% to 60% for both brands and generics above the cap.

- Manufacturers will be required to provide a 20% price discount on brand-name drugs and provide a 10% discount on brand-name drugs between the deductible and the annual out-of-pocket spending cap, replacing the 70% price discount in the coverage gap phase under the current benefit design.

- Timeline

- For 2025, Manufacturer will enter into the agreement no later than March 1, 2024, for agreement to be in effect starting January 1, 2025, until December 31, 2025.

- For 2026 and subsequent years — Manufacturer will enter into the agreement no later than a calendar quarter or semi-annual deadline to be established by the Secretary.

- Drugs Subject to the Discount

- NDA or BLA approved and drugs that are covered by Part D prescription drug plan or MA-PD plan.

- ANDA-approved drugs will not be subject to the discount.

- Drugs selected (i.e., subject to a maximum price) under Section 1192(c) during a price applicability period will also not be subject to the discount.

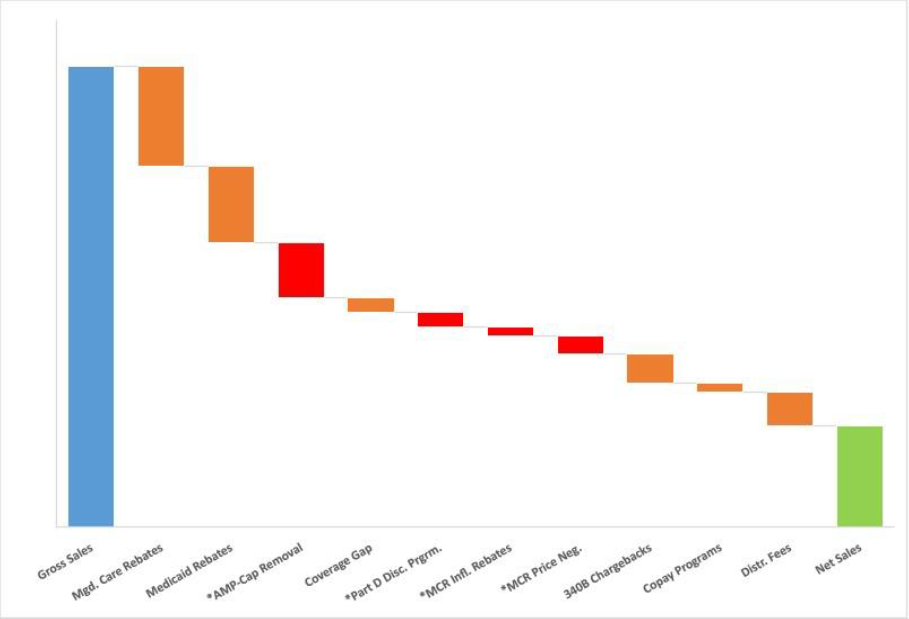

Gross-to-net Implications of Part D Benefit Redesign

The new Part D benefit redesign will likely drive up GTN exposure due to the LIS expansion and other potential spillover effects.

- LIS Expansion

- By expanding the benefits to full eligibility for LIS beneficiaries, these beneficiaries’ Part D drug costs will now be subject to the new manufacturer discount program beginning in 2025.

- This increase of LIS patients will translate into more liability and margin pressure.

- Lower Out-Of-Pocket Threshold

- Because the OOP threshold is lowered to $2,000 in 2025, patients will enter the catastrophic phase sooner (in contrast, for 2024 catastrophic begins at $3,250 OOP spend).

- For high-cost drugs, manufacturers will have to pay 20% for the drug cost in the catastrophic coverage phase through the remainder of the benefit year, as there is no cap on the catastrophic coverage phase.

- Manufacturers with high-cost drugs, or with patients taking co-morbid high-cost drugs that will push them into the catastrophic coverage phase, could see higher rebates than under the Coverage Gap.

- Patient Adherence

- By closing the Coverage Gap, the out-of-pocket costs for beneficiaries goes away after $2,000 of spend in the Deductible and Initial phases.

- This theoretically could improve patient adherence, increasing both the total volume of Medicare Part D utilization and the shift of liability from the Initial Phase to the Catastrophic Phase, thereby increasing manufacturer liability under the Part D Discount Program.

- Spillover effects of IRA

- Under the Benefit Redesign, Medicare Part D Plans now have to pay 60% of beneficiary drug costs in the 2025 catastrophic phase as opposed to 20% in the 2024 Coverage Gap design.

- Additionally, as noted above, Beneficiary Part D premium growth will be capped at 6% per year from 2024 – 2030.

- Part D plans will likely look to manufacturers in the form of increased Part D rebates to compensate for the increased exposure.

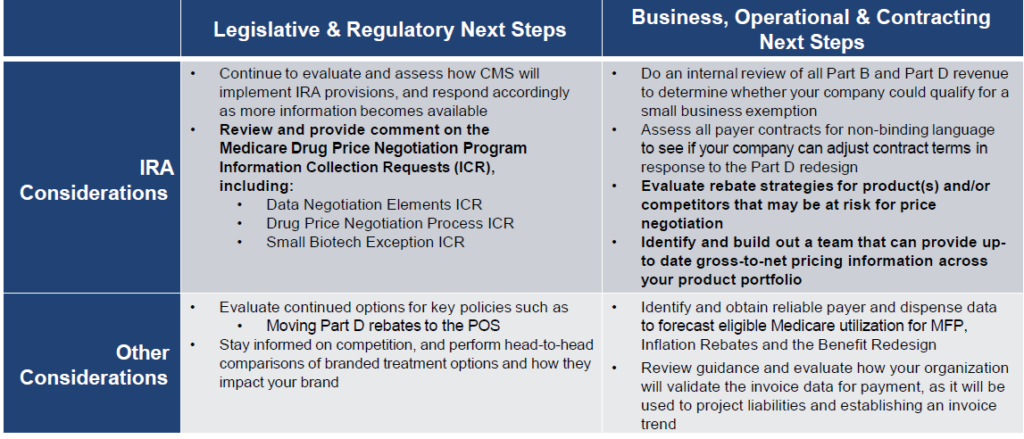

How to Prepare for IRA Implementation

Finance and Commercial functions should begin preparing for IRA implementation today by studying the statute, identifying the key stakeholders responsible for IRA implementation, and identifying the data required to model the GTN impacts.