CMS Proposed Rule on Stacking for BP: Are you ready for the Challenge?

On May 26, 2023, the Centers for Medicare & Medicaid Services (“CMS”) published a proposed rule titled “Medicaid Program; Misclassification of Drugs, Program Administration and Program Integrity Updates Under the Medicaid Drug Rebate Program” (the “Proposed Rule”). In this thought paper, we dive deeper into changes to Best Price (“BP”), including CMS’ revision to prior guidance by now requiring that manufacturers “stack” cumulative discounts and rebates to different entities. Should you have any questions or thoughts to share, please feel free to reach out to us, and we would be glad to help you.

Get the PDF version of this article for offline reading or reference: Download PDF

Require Stacking When Determining Best Price

In the Proposed Rule, CMS is modifying the determination of Medicaid BP to stipulate that manufacturers must stack, or aggregate cumulative discounts, rebates, or other arrangements to generate a final net price realized by the manufacturer for a particular unit of a Covered Outpatient Drug (“COD”). Even when discounts, rebates, or other arrangements for price reductions are provided to different best price eligible entities.

According to the Proposed Rule, if a manufacturer provides various discounts for the same drug unit to two different entities, all the price concessions that affect the price offered by the manufacturer would be taken into account when calculating the final best price of that drug.

Some in the industry have described this as ‘follow the pill,’ where every discount given on the same pill is aggregated (“stacked”) together to determine best price. This rule would apply even if the entity did not purchase the drug directly from the manufacturer. As a result, this stacking requirement would lead to an increase in the Medicaid drug rebate provided to the state and federal government and a decrease in the 340b Ceiling Price.

To be clear, this is a substantial change to the BP definition and will have significant impacts on many manufacturers. It will also be challenging to implement. As a refresher and to help bring to life the proposed change, we summarized and provided an illustrative example below comparing BP pre and post proposed rule.

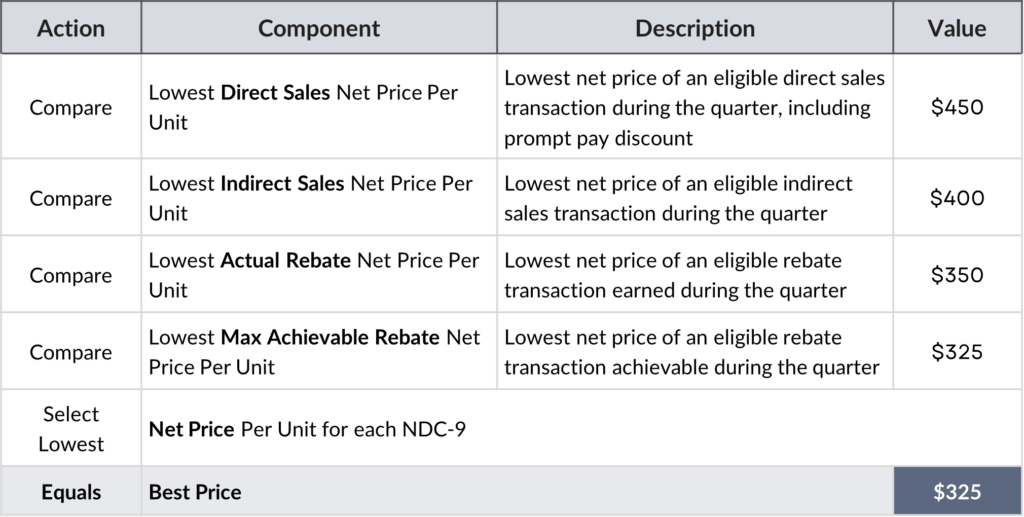

Best Price (before the CMS Proposed Rule)

Quarterly Best Price:

- Generally thought of in the industry as the lowest “commercial price” to a single BP eligible entity offered and realized.

- The lowest price available for single source (“S”) and innovator multiple source (“I”) drugs from the manufacturer during the rebate period to any wholesaler, retailer, provider, health maintenance organization, nonprofit entity, or governmental entity in the US, in the same quarter for which AMP is calculated. (AMP Final Rule 81 Fed. Reg. 5251)

- Identified at the NDC-11 level and reported at the NDC-9 level for all branded products.

- Single transaction can set best price.

- Includes commercial retail and non-retail (i.e., “all commercial”)

- Sales to the federal government, under federal contracts, PHS entities, etc., are excluded.

- Takes “stacking” into consideration, where one customer gets multiple discounts on the same unit of drug.

- Monitor contracts for “bundling” scenarios and perform unbundling allocations to assign discounts given to appropriate products in appropriate periods.

- Used as a component in the Medicaid Unit Rebate Amount (“URA”) calculation.

- Excludes Bona Fide Service Fees.

- Calculated and submitted to CMS quarterly.

Current environment vs post-CMS Proposed Rule with new cumulative stacking rules

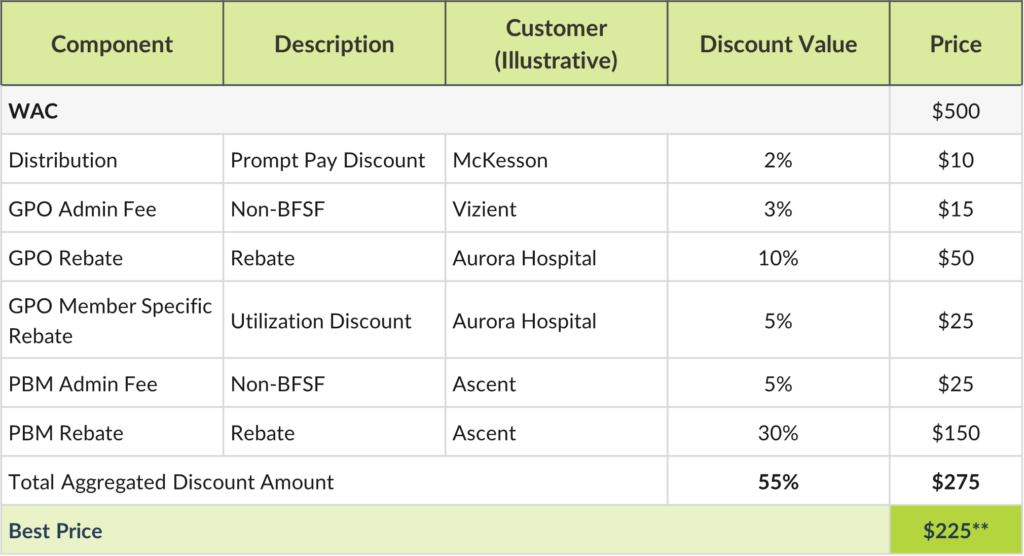

Illustrative Example: Traditional Retail Brand Product:

In the example below, we follow a traditional brand product and consider the current environment for BP calculations compared to the proposed rule with aggregate stacking.

Parameters

- Product WAC = $500

- Product is subject to the following discounts due to contracting relationships with distributors, specialty pharmacies, Group Purchasing Organizations (“GPOs”), and Pharmacy Benefit Managers (“PBMs”)

- Prompt pay discount

- Off WAC discount

- Administrative fees that were determined to be non-bona fide for purposes of this exercise

- Rebates

Best Price High Level Calculations

Current Environment

Post-Proposed rule with new aggregate stacking

** With aggregate stacking rules, discounts would be compounded for a single product as it flows through the value chain. In the above example, all potential discounts for a single product would be combined together including any non bona fide service fees leading to a best price that would be lower than the commercially available price. Note in this example, this is significantly less than the BP under the current rules and is not even a commercially available price to any single customer.

FCS Perspectives and Recommendations

We routinely work with our clients to navigate CMS’ guidance to help ensure that they are calculating all government price types according to the defined methodologies and reasonable assumptions approved by clients’ legal counsel. This new aggregated stacking proposed rule will require significant consideration by manufacturers from compliance, operational, and financial perspectives.

One area having significant additional compliance, operational, and financial impact is bona fide service fees. With this new Proposed Rule, the compliance and accuracy of the BP depends on the results of bona fide service fee evaluations. Fees paid to entities that do not typically set BP, such as wholesalers may now contribute to the aggregated “stacked” BP if found to be non-bona fide. To address the added importance of bona fide service fee determinations, we recommend manufacturers:

- Develop processes and incorporate tools (i.e., checklist/questionnaires/FMV estimators) to help facilitate and incorporate BFSF evaluations in the contracting process. This is a key item to help ensure that service arrangements are being evaluated not only from a fair market value perspective but also taking a close look at the qualitative prongs of the test (i.e., is this a service on our behalf, is their pass-through evidence or notice, services itemized in the contract) and having a framework in place for the evaluation including when to seek counsel advice. In practice, we’ve seen it work well when manufacturers.

- Perform periodic BFSF/FMV training so business teams are aware of process and mindful of current rules, regulations, and that the company creates and maintains documentation of the BFSF analysis and treats the fees appropriately in government pricing.

- Monitor and track performance of service providers and overall spend and evaluate whether there’s an opportunity to mitigate risks.

- If your contracts allow the vendor to invoice net of service fees, discounts, and other adjustment on their invoices, ensure that you are reviewing them and treating the fees appropriately. Note this is an area that is commonly overlooked especially as it relates to items like price appreciation credits. It’s important to note that CMS has made clear that price appreciation credits are not BFSF and should be included in calculations

- Document your BFSF evaluation, follow your BFSF process, perform FMV, and ensure that fees are treated appropriately based on the results of the BFSF evaluation. As a reminder, there is no conservative approach for BFSF (i.e., depending on your product, what’s conservative in one government program may be aggressive in another). Note we generally recommend checking with counsel; especially for new or complex arrangements, if it’s your first evaluation, or if it’s a sensitive matter that should be performed under privilege.

- If you’ve already performed FMV and BFSF evaluation, keep a track and perform periodic refreshes as needed. We typically recommend every 2-3 years, unless something significantly changes (i.e., sales or service changes, new rules/guidance, etc..).

There are other challenges to be considered as well. From an operational standpoint, what system or process will a manufacturer have to aggregate discounts across customers? Can government price calculation systems automate this? Such systems already have challenges with traditional stacking determinations of multiple discounts to one customer. Manufacturers may have additional manual processes and will need strong system controls to ensure that discount data points are captured efficiently across customers and can measure aggregated discount levels, while still ensuring the customers would all be connected on the path of the pill from distribution to patient. How should this model work, and how can it be integrated into the government price calculation process at your organization? How are manufacturers planning for additional steps to evaluate new contractual arrangements and terms and downstream impacts to gross-to-net forecasts.

Financial impacts could be the greatest of all. As our illustrative example shows, for some products with many discounts across customer channels, the aggregated stacked best price could be 50% lower or more. That will have a large impact on Medicaid’s Unit Rebate Amount, causing new financial liabilities for rebates, as well as lowering the 340b Ceiling Price, most likely. Manufacturers need to be aware of magnified impacts of these proposals, especially when combined with other upcoming policy changes including the Average Manufacturer Price (“AMP”) cap removal set to go into effect on January 1, 2024 and Inflation Reduction Act (“IRA”) negotiated Maximum Fair Price (“MFP”) which may set BP. The financial implications can be significant and estimating these potential impacts now to increase the visibility across the organization is essential. Preparations can begin on evaluating new contracting strategies that may decrease the impact of aggregated stacking. For example, does offering a prompt pay discount still make sense, or does the potential BP implication outweigh the benefit? Prompt pay discounts are currently very common to have in full-line wholesalers, distribution arrangements, and other agreements where the channel partner takes title. As shown in the example above, in a world where every discount offered on a single product is stacked, this may no longer be an optimal way to contract.

Sources: Link to proposed rule text